Banking

Smarter Digital Onboarding for Modern Banking

Open accounts, disburse loans, and verify customers - anywhere, anytime. Signzy helps banks deliver a seamless verification and onboarding experience with AI-powered KYC, KYB, and AML solutions that are fast, secure, and fully compliant with global regulations.

100M+

Users Verified

2x

Fraud Detection

<5s

Response Time

Trusted by industry leaders

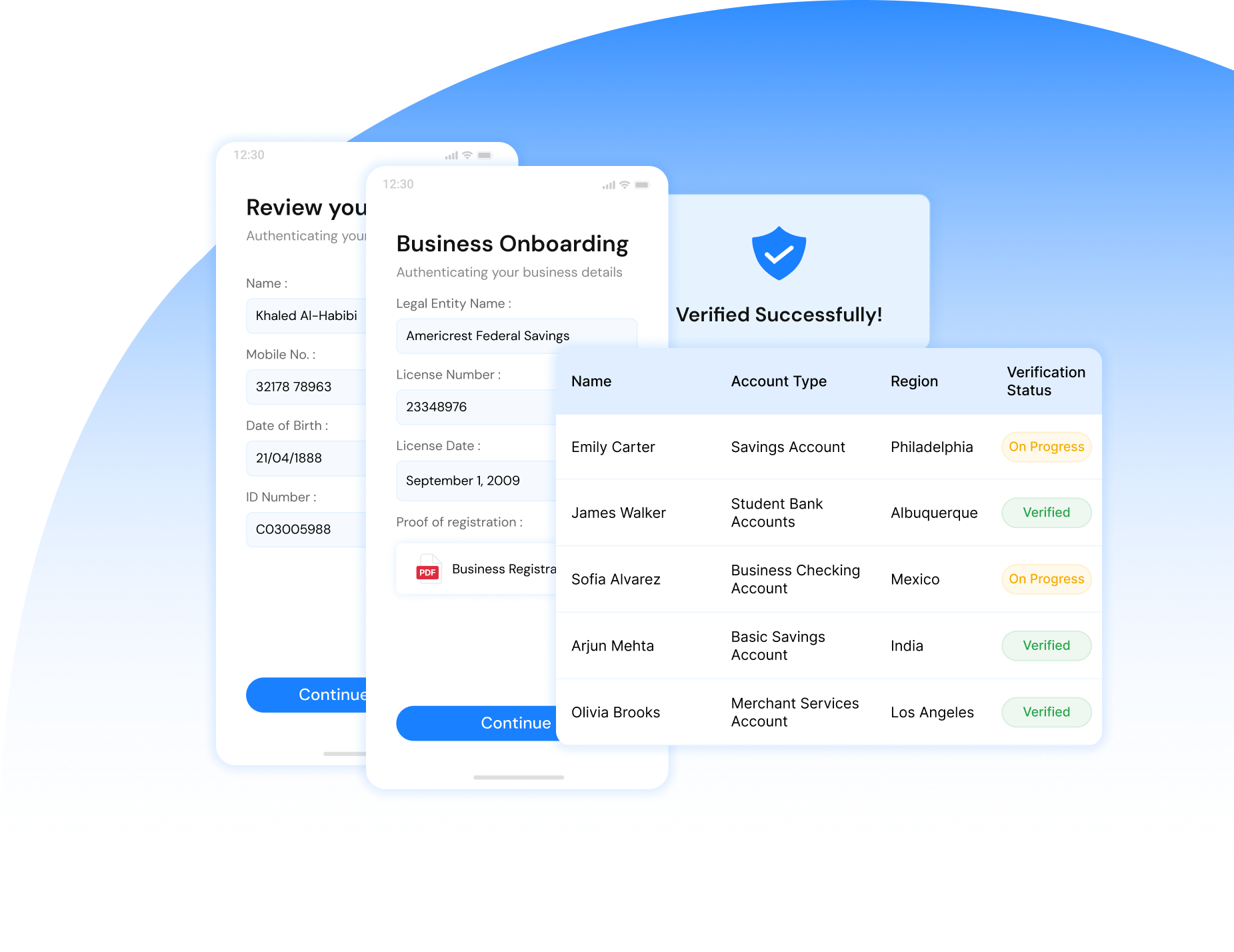

Verification That Moves at the Speed of Your Banking

Reduce fraud and risk exposure from day one

Authenticate users using biometric face match, liveness checks, and document forgery detection. Run instant checks against PEP, sanctions, and watchlists to flag high-risk profiles early. Protect your institution from synthetic identity fraud, money mules, and fake loan applications.

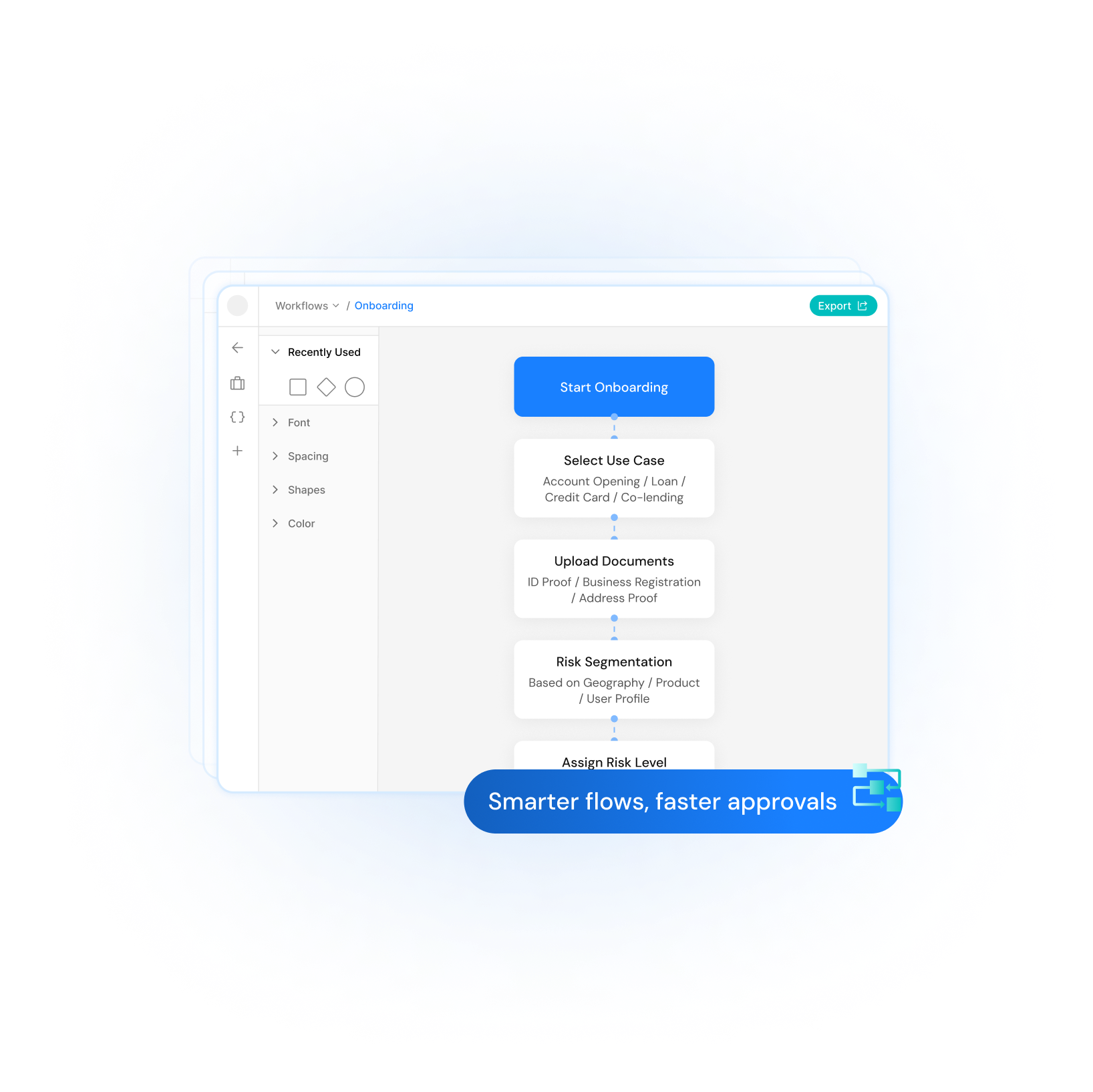

Customizable workflows for every banking use case

From account opening and loan disbursement to credit card issuance and co-lending, configure risk based onboarding journeys with Signzy. Segment users by risk level, geography, or product type.

Full-stack KYC, KYB, and AML infrastructure at one place

Access a unified API suite for individual and business verification, bank account validation, document OCR, and transaction monitoring: purpose-built for banks looking to digitize and future-proof their onboarding stack.

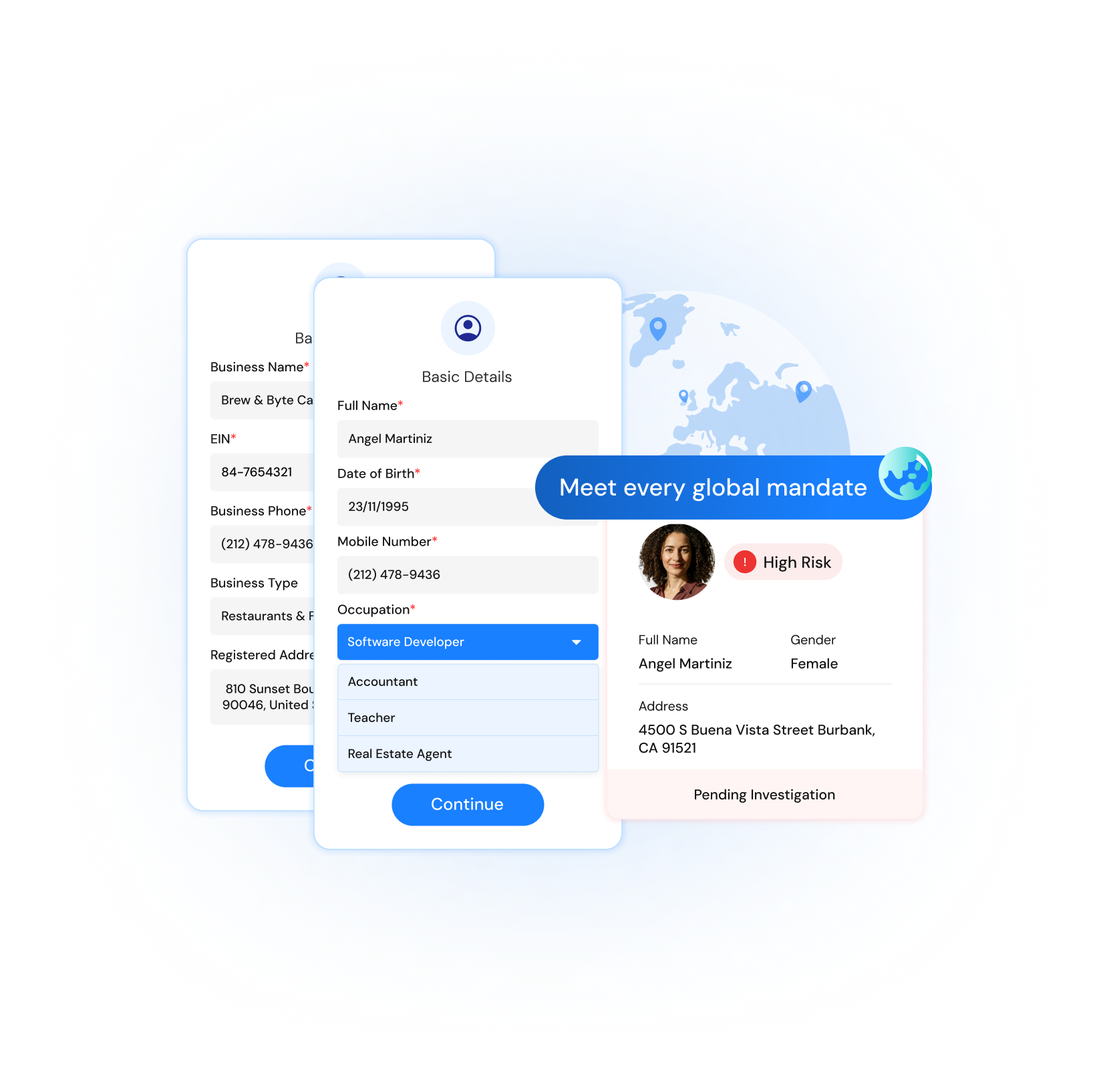

Stay compliant across global banking regulations

Meet the onboarding and compliance requirements of global regulators in 180+ countries. Whether you’re onboarding retail users or SME clients, our banking-grade KYC and AML engine ensures full alignment across jurisdictions without increasing friction.

Our Innovations

End-to-End Digital Identity Infrastructure Designed for Banks

Biometric Verification

Liveness Detection & Face Match Built for Banking Risk Standards

Verify users in real time using advanced face biometrics and passive liveness checks. Prevent deepfake fraud, impersonation, and spoofing at the source, ensuring secure onboarding across retail, corporate, and priority banking segments.

Document Verification

AI-Driven OCR and Tamper Detection for Global ID Docs

Extract and validate data from 14,000+ document types worldwide—including passports, driver's licenses, and national IDs. Detect forged or manipulated documents with high-accuracy AI models built specifically for banking KYC needs.

Data Validation

Cross-Check KYC Data Against Authoritative Sources

Verify SSN, driver license and other national identifiers in real time. Connect with watchlists, credit bureaus, and central registries to detect mismatches, reduce fraud, and ensure customer data integrity at onboarding.

Bank Account Verification

Instantly Validate Payout and Salary Accounts

Authenticate ownership and account status within seconds using our bank account validation APIs. Eliminate payout failures and safeguard your bank against refund fraud, incorrect mandates, and erroneous disbursements, especially in lending, insurance, and payroll flows.

Signzy’s Banking-Grade Verification Suite

Built for Global Banks and Regulated Financial Institutions

One Touch KYC

Instant Identity Verification for Global Banking Customers

Onboard individual users and business clients across 180+ countries in seconds. One Touch KYC combines AI-powered liveness detection, face match, and OCR-based document extraction to deliver fast and accurate identity verification while staying compliant with global regulations. Ideal for retail, SME, and corporate banking onboarding across markets.

Transaction Monitoring

Real-Time AML Surveillance for Global Transaction Flows

Monitor millions of transactions daily across regions and channels. Our intelligent rules engine flags suspicious behavior based on geographic risk, velocity patterns, and custom AML logic helping you meet FinCEN, FATF, EU AMLD6, and FIU-IND directives without disrupting your banking operations.

MuleShield

Proactively Detect and Stop Money Mule Networks in Banking

Protect your bank from organized fraud rings and mule accounts. MuleShield analyzes behavioral biometrics, transaction velocity, and relationship mapping to detect hidden mule activity early - minimizing fraud losses, especially in loan disbursements, salary accounts, and digital account opening.

No-Code Compliance Platform

Design Custom KYC and Risk Workflows—Without Developer Help

Whether launching new onboarding flows in a region or adapting AML rules for a new product, our drag-and-drop platform lets compliance and ops teams build, test, and deploy tailored workflows in days. Perfect for enterprise banks modernizing their digital onboarding stack.

Integrate once and secure your data forever

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

Related Blogs

FAQ

How does Signzy help banks digitize onboarding across geographies?

Signzy offers a unified platform for KYC, KYB, AML, and fraud prevention—helping banks onboard retail and business customers across 180+ countries. Our workflows adapt to regional regulations, enabling faster onboarding with full compliance.

Can Signzy prevent onboarding fraud like identity theft or mule accounts?

Yes. Our platform uses liveness detection, face biometrics, and forgery detection to prevent identity spoofing, deepfakes, and synthetic identity fraud. Our MuleShield product also detects suspicious behavior patterns across accounts and networks.

Can we customize onboarding flows for different banking products?

Absolutely. Signzy's no-code builder allows banks to configure tailored KYC/AML workflows for savings accounts, personal loans, credit cards, co-lending, and more—without any engineering effort.

How does Signzy support KYB for corporate and SME customers?

We verify business entities, UBOs, and directors using global registries, government databases, and PEP/sanction screening. This enables faster, compliant onboarding for SMEs, startups, and corporate clients in lending, treasury, and merchant banking.

Is Signzy secure and compliant with banking-grade infrastructure standards?

Yes. We are ISO 27001, SOC 2, and PCI-DSS compliant, and support data residency as required. Our infrastructure meets the privacy, security, and auditability needs of Tier-1 banks globally.